C O V I D – 1 9

C O N S T R U C T I O N U P D A T E

I R E L A N D

The Covid-19 pandemic has had a profound impact on all of our lives. While it is much too early to assess the full implications, we can assess the direct impact on construction activity on the island which has essentially ceased beyond works directed at repurposing medical and care facilities and essential maintenance works.

To provide some context we shall draw from some preliminary assessments of the wider economic impact and look at the support and stimulus packages deployed by the Irish and UK governments to try to bridge the gap to recovery.

Within the construction industry itself we detail the level of ‘on-the-ground’ activity that has ceased, providing a snapshot analysis just before restrictions on activity came into force. We will also look at the impact on pipeline activity noting the decline in planning applications, planning decisions and public sector tenders and the differing approaches across both jurisdictions.

Economic Context

Trying to assess the economic impact of the evolving Covid-19 crisis is almost impossible at this early stage. Minds, quite rightly are focussed on preserving life and helping those most in need. However, over the next number of weeks, as the crisis approaches a zenith in Ireland, focus will turn to plotting a path to recovery.

An excellent report[1] by Prof. Neil Gibson, Chief Economist, EY Ireland, examines the impact on jobs and GDP within the economy. By the report’s own admission their figures are subject to a wide margin of error.

Using CSO data and official labour market statistics the report illustrates the effect on various sectors. Sectors which have effectively ceased include Accommodation and Food, Arts and Recreation and Other Personal Services which account for 298k jobs in ROI (2.9% of GDP) and 103k jobs in NI (5.3% of GDP).

Severely disrupted sectors including Retail, Real Estate, Manufacturing and Construction account for 726k jobs in ROI (49.9% of GDP) and 317k jobs in NI (47% of GDP).

The numbers employed in construction in Ireland pre-Covid19 were 147,000 (ROI) and 62,300 (NI).

“Covid-19 will permanently change the shape of the economy on the island of Ireland. Sadly, many lives will be lost and a number of businesses are also likely to perish, regardless of the level of Government or private sector ending support that is offered. There has been considerable talk about a return to normal, but the impact of this crisis may forever change our attitudes to saving, healthcare, lifestyle and even our career choices.” (Prof. Neil Gibson, Chief Economist, EY Ireland, 2020)

[2] https://www.ey.com/en_ie/covid–19/covid–19–economic-impact–trying–to–bridge–across–the–unknown

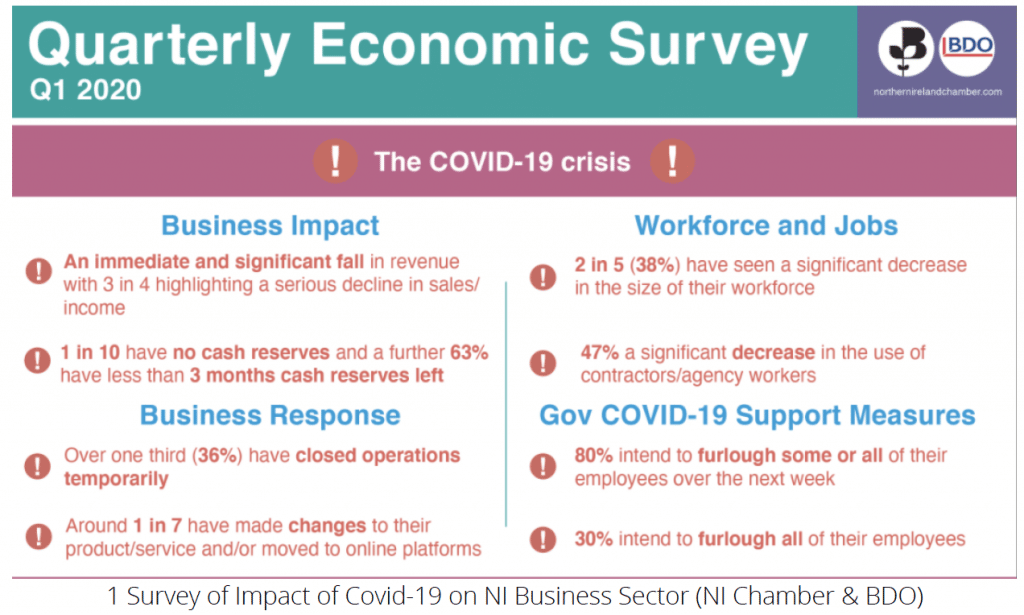

The impacts, under this illustrative scenario for 2020, forecast a 7.3% drop in employment in ROI from a pre-Covid-19 projected rise of 3.4% and a 6.7% drop in NI from a pre-Covid-19 projected rise of 0.8%. In terms of impact on GDP, accounting for government intervention, ROI and NI would show an overall decline of 177K and 78K respectively. Qualitative data based on a survey of NI business by the Northern Ireland Chamber of Commerce and BDO[1] gives us an insight into the stark impact of Covid-19. (NI Chamber& BDO, 2020)

Supports and Stimuli

Policy across the island has been directed towards bridging the crisis to maintain jobs and support business survival to position the economy for recovery. The levels of intervention have been unprecedented but the required level of intervention to maintain even minimum levels of economic activity are as yet unknown. In the Republic of Ireland key supports introduced include:

- Wage subsidy scheme – 70% of weekly take-home wage up to a maximum of €410 per week

- Cash flow support business including business loans and grants for small business.

- Deferral of commercial rates and extension of filing deadlines for company returns

In Northern Ireland the supports include:

- Cover for up to 80% of staff wages, up to £2,500 per employee for those employees who would otherwise have been laid off.

- Self-employed Income support scheme

- Business Interruption Loan Scheme and grants for small business

- Reduction and deferment of business rates, tax and VAT

- Statutory sick pay rebates

Construction Industry

Activity Ceases

The final week in March was a fateful one for the Construction Industry in Ireland. On Monday the 23rd March the UK’s prime minster Boris Johnson announced stay-at-home’ and social distancing guidance. In response the Construction Employers Federation in NI made a statement the following day indicating that it was their view that “with the exception of essential works in support of the fight against Covid-19, non-essential construction work should cease.” In the Republic of Ireland on Friday March 28th Taoiseach Leo Varadkar announced similar lockdown measures. By the end of March construction activity in Ireland had effectively ceased with the exception of the delivery of “essential works”:

- Supporting health, emergency and security services

- Supporting education/childcare services

- Maintaining water and sewerage

- Maintaining utilities and telecoms

- Maintaining transport links

- Maintaining housing and care environments

- Supporting essential distribution and logistics networks eg shops, online retail, post

Impact

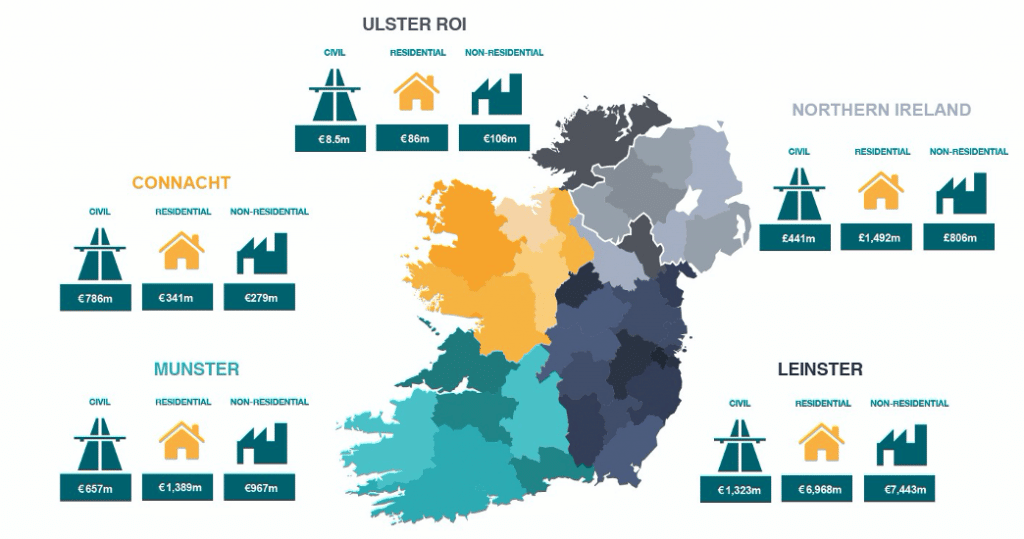

CIS have taken a snapshot of construction activity at the end of March which quantifies the impact across the various sectors[5]. Our researchers have identified 1,137 active sites in the Republic of Ireland which have ceased with a combined overall value of €17.9b. In Northern Ireland we identified 345 active sites with a combined value of £2.7b.[7]

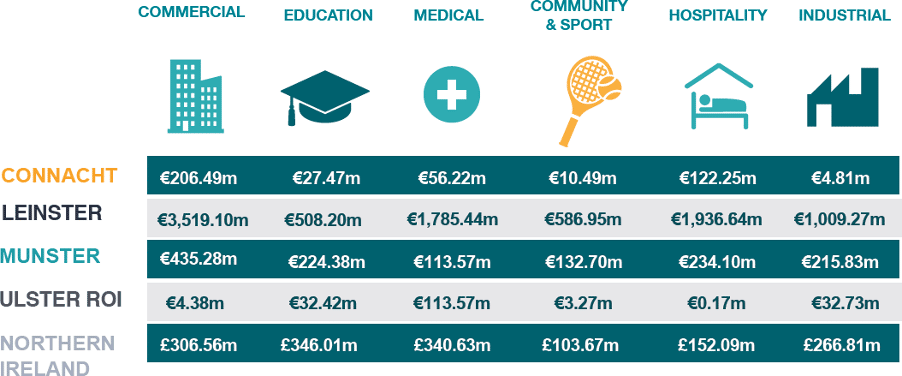

Covid-19 Active Construction – Impacted Regions by Sector & Value

The following tables illustrate a further breakdown of these figures by sector and region.

Non-Residential Sectors

The total number of projects effected in these sectors are 517 (ROI) and 153 (NI) with a total combined floor area of over 5 million square metres. Whilst sites were at various stages of completion the gross overall figures for impacted sectors represent:

- 5092 hotel bedrooms

- 5377 student bedspaces 1789 nursing home beds 946 classrooms

- 1106 hospital beds

172 projects were valued at over €10m (78 of these in Dublin alone).

Residential Sector

There was a total of 796 active residential developments at various stages of development when the pandemic restrictions were imposed representing nearly 60,000 residential units in total and a combined value of €9.55b (£806m in NI). Dublin alone had 185 active sites with a combined value of €4.3b.[9]

Civil Sector

CIS have identified 80 major civil projects that were ongoing with a total project value of €3.21b. Fifty six of the projects were in ROI and 24 in NI representing €2.8b and £441m respectively.

[5]A full interactive report is available on our website www.cisireland.com

[7] See Methodological Notes at end of this document

[9] Sites comprising 10 sites or more

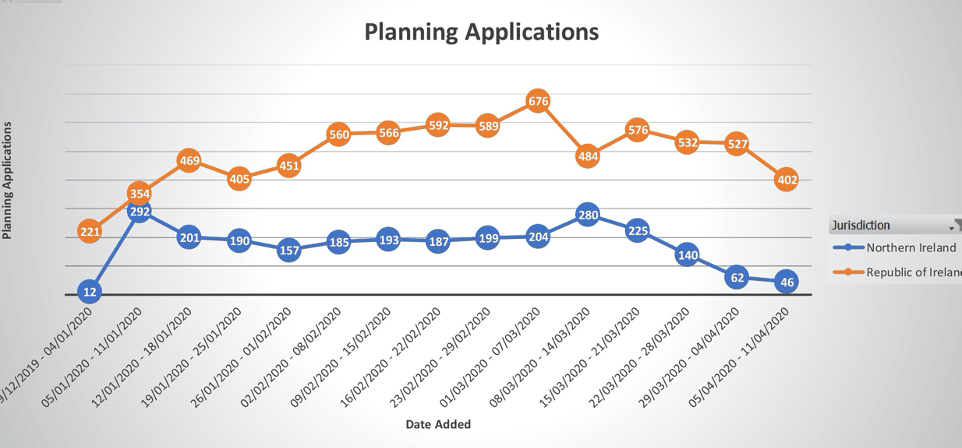

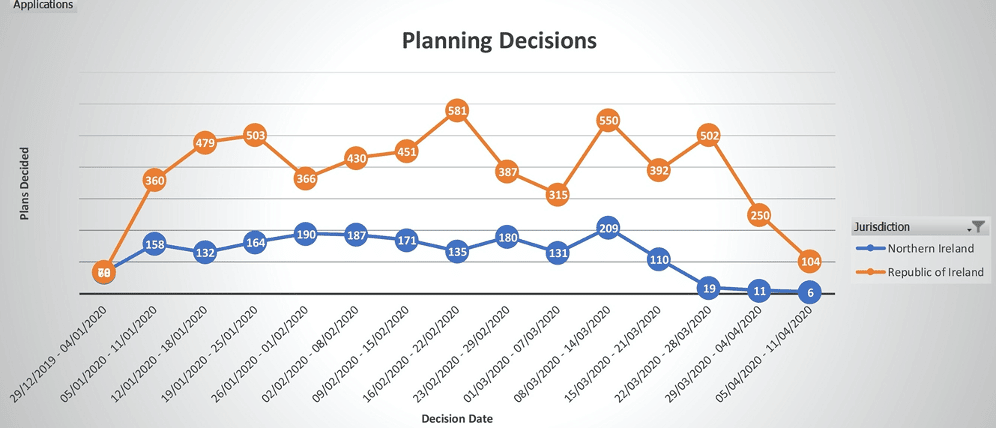

Construction Pipeline Planning Applications

On March 24th emergency measures were introduced in the Republic of Ireland providing for the suspension of legislative time periods in the Planning and Development Act. Further legislation on March 29th directed that decisions for applications lodged up to March 29th could not be made until after April 20th to ensure sufficient public participation. The five-week period for public consultation for applications made after March 29th will not commence until April 20th.

In Northern Ireland the Covid-19 pandemic has already had a significant impact on the ability of local councils to process planning applications. Options are still being considered but the Department for Infrastructure has encouraged planning offices to make their best efforts to process decisions within the legislative timeframes which for now remain in place. The acceptance of new planning applications is dependent on the council area. Some councils (Ards and North Down Borough Council, Belfast City Council, Causeway Coast and Glens Borough Council) have indicated that they will not accept new applications whilst others are accepting applications as normal or by post.

In reality CIS research has noted a marked decline in all planning activity in Northern Ireland while in the Republic of Ireland applications remain buoyant for now but there has been a significant recent decline in planning decisions.

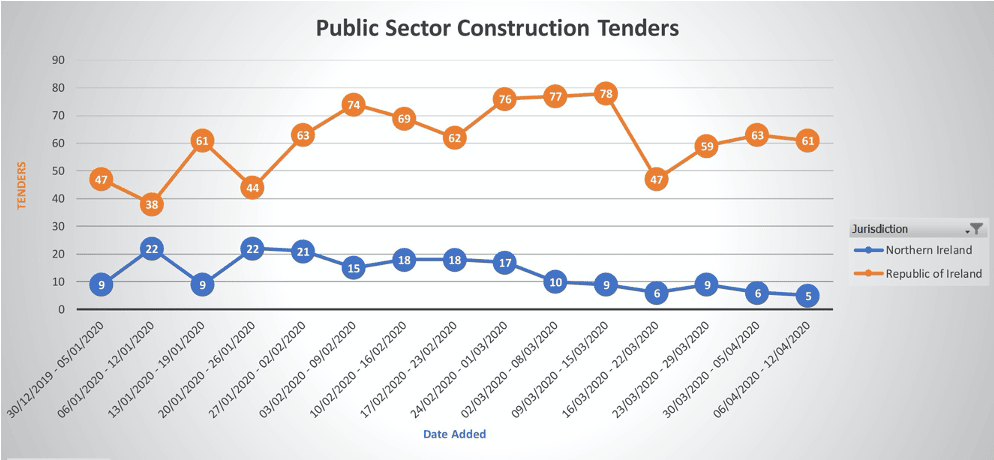

Public Sector Tenders

Differing pictures again emerge between the jurisdictions in relation to public sector tenders. CIS researchers have identified a significant number of tender deadline extensions which is to be expected. In terms of activity however ROI tenders for construction works and related services have continued to be published showing only a 25% decline in activity. In Northern Ireland public sector procurement tenders have declined significantly by approximately 75%.

Conclusions

Whilst we remain in the midst of the Covid-19 crisis activities are directed at preserving life and supporting workers and communities. Attempts to plot a recovery path are faced with too many unknowns as yet to make predictions or projections with any degree of certainty.

Within the construction sector we would anticipate however that activity will recommence first on sites that were actively under construction when pandemic restrictions first came into force. The speed with which the industry can get back to the levels outlined here is dependent on many variables including financial capacity, materials and supplies, workforce availability, workplace conditions, legislative backlogs and government policy.

CIS will continue to track and monitor activity and report progress as we all strive to overcome the immense personal and economic impact of this crisis. In our forty plus years of operation we have witnessed two serious recessions prior to this crisis. We are a resilient people and whilst there will be much pain and loss, we will adjust once again to adversity and come back stronger than before.

The CIS pre-Covid-19 Construction Activity Interactive Report is available on our website www.cisireland.com. If you would like further information or specific analysis relating to specific regions or sectors please contact us.

Methodological Notes

CIS monitor construction activity in Ireland at project level. Our team of researchers track major projects from planning to completion and gather relevant data and metrics. The analysis in this report is based on projects over €500k/£500k and excludes self-build projects. Whilst we do track all projects, including residential self-builds and extensions, our analysis has shown that projects over €500k/£500k and residential developments of 10 units or more represent, on average, over 90% of total project value with their sectors.

The figures on activity shown here represent gross figures for On-site activity. For expediency, we have not factored in the stage of developments or the degree to which they have been delivered. In particular we urge caution when looking at residential figures as many phases of these developments have already been delivered (with the exclusion of apartment developments).

References

NI Chamber & BDO QUARTERLY ECONOMIC SURVEY & COVID-19 BUSINESS IMPACT TRACKER [Report]. – Belfast : Northern Ireland Chamber of Commerce and Industry, 2020.

Prof. Neil Gibson, Chief Economist, EY Ireland

Covid-19 Economic Impact: Trying to bridge across the unknown [Report]. – Dublin : EY, 2020.