The results from Q1 2022 highlight the continued resilience of the construction industry against the backdrop of multiple unique challenges – rising material costs, disruption of supplies, Brexit, the pandemic, rising fuel costs and other impacts of the war in Ukraine.

Across the island new project starts rose to just over €3bn for the quarter, the third highest quarter value recorded in the last three years, behind Q2 2021 (€4,4bn) and Q3 2021 (€3.2bn) and up form a three year quarterly average of €2.3bn.

There are variations of course across sectors. New starts in the residential sector fell for the third consecutive quarter to €979m (excluding new phases of existing developments). In the non-residential sector starts rose in Q1 to €1.2bn, a 27% rise on the quarterly average over the last three years. Indeed, the only sectors falling below the previous three-year average for new starts were medical, retail and hospitality.

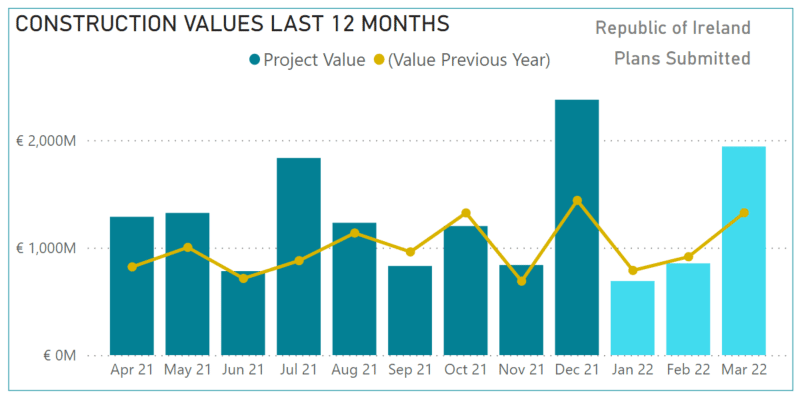

Plans Submitted

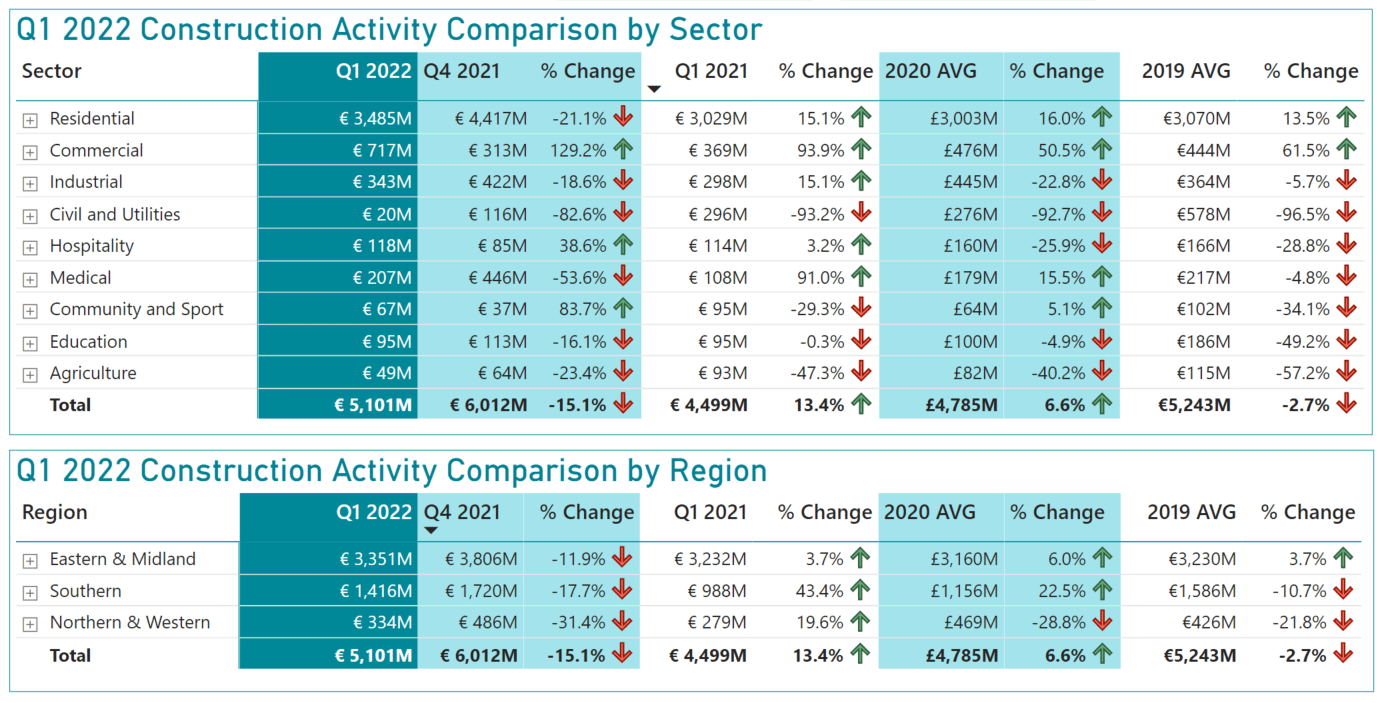

The value of ROI planning applications lodged in Q1 2022 was €3.5bn, which was higher than the previous three-year average but down 21% from the previous quarter. In comparison to the same period last year, the number of residential units increased by 31% to approximately 18,000. The number of apartments planned is 9,681, an increase of 18.5% over the previous year, and is more than the number of traditional dwelling units planned, which is 8,263. A 2% decrease in the value of housing in the Eastern and Midland Regions from Q1 2021 is countered by rises in the Southern Region (69%) and the Northern and Western Regions (123%).

Planning applications for non-residential projects totalled €1.6bn in the first quarter, up 36% from the same period last year and 8% from the preceding quarter. Plans for 911 hotel beds, 682 nursing home beds, and 273 classrooms were among the applications. This quarter’s considerable expansion in the business sector was driven mostly by plans for new offices. The hospitality industry grew, but at €118m, it was still less than the previous three-year average of €150m.

Plans Granted

The value of planning grants for residential applications declined by 16% from the same period last year and by 12% from the preceding quarter, totalling €1.9bn. In the quarter, a total of 272 projects were granted planning permission, equal to 9,686 residential units – a 16% increase over Q1 2021. Apartments and traditional housing were about equal in terms of planned developments, with one and two-bedroom apartments accounting for nearly half of all grants. The number of units granted approval in the Eastern and Midland regions declined by 10%. Units authorized in the southern region increased by 151%, with approximately 3000 units approved.

In the non-residential sector, the value of plans granted in Q1 was €1.3bn, which was 15% lower than the previous three-year average and 15% lower than the same period last year. There were 15 hotel developments approved, totalling over 1,000 hotel beds. 168 projects worth €270m have been approved for the commercial sector, representing a 34% decrease from the first quarter of 2021. In the education sector, 63 new projects have been approved, including plans for 254 new classrooms. In the medical sector, approval was granted for 196 new hospital beds and 354 nursing care beds. A total of 67 public sector projects were approved, totalling €222m in investment, a 19% decrease from the first quarter of 2021.

Commencements

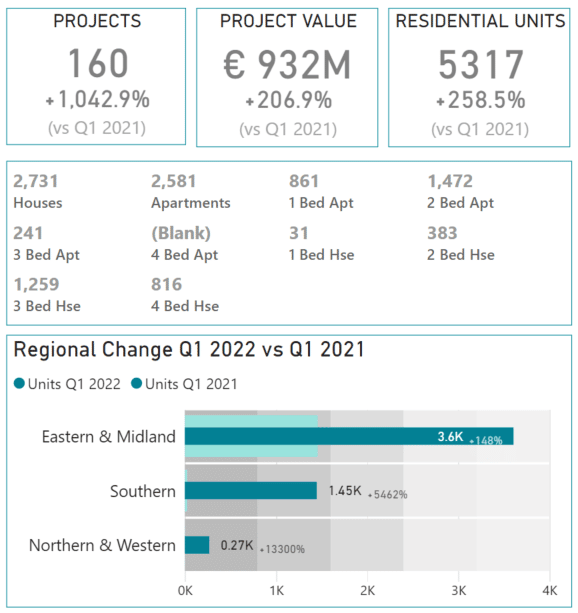

New projects started comprise of a gross total of 5.3k units, which is less than the three-year average of slightly more than 6k. All regions exhibit a huge growth compared to Q1 2021, when the economy was partially shut down. In the third quarter, 160 new housing projects worth €932m were launched. Apartments and dwellings are currently being built at the same rate.

In the first quarter of 2022, 342 new non-residential projects were commenced, totalling just over €1bn. Starts for 2022 are on course to exceed last year’s record of €9.6bn, a 28% increase over the previous three-year average of €805m and a 140% increase over Q4 2021. During the quarter, 539 hotel beds, 274 nursing care beds, and 217 classrooms were all opened. The value of starts was higher in all three regions than the previous three-year average, with the Southern region nearly twice the average.

Conclusion

Download the Full Report here

If you are not already a customer, you can take advantage of our Free Trial to gain access to the interactive report as well as our many other system features. If you have any questions about the data in this report, please contact us at [email protected] or on 353 1 2999 200.

Download CIS reports by clicking the button below.

Download CIS reports by clicking the button below.