Introduction

The rising cost of energy and supply security are now a regular feature of daily news coverage. In recent months, we have seen the volatility of compromised energy supplies across both global and domestic jurisdictions. This report seeks to quantify our key energy projects and provide a brief overview of how the renewable energy sector is performing in Irish construction. In order to assess the direction of Ireland’s efforts in this area, we must examine the pipeline of planning, the infrastructure we started to build and what has been completed. While it is imperative to analyse the results both regionally and statistically examine construction performance, this report will hopefully provide insight into the global forces and governmental initiatives driving this sector. Here is a brief summary of what CIS has observed in the construction industry over the last 48 months in terms of renewable energy projects, transportation, housing, deep retrofits, public contracts, and materials.

A Regional & Statistical Overview of Wind & Solar Projects in Ireland

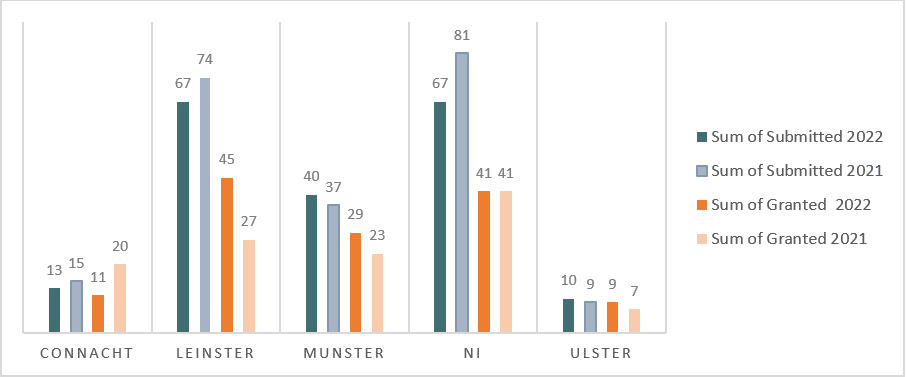

Planning Pipeline

From observing the volumes of wind and solar at both submitted and granted stages, we can see that the renewable energy sector remains buoyant across Connacht, Ulster (ROI) and Northern Ireland. Planning activity appears to be strongest in Leinster & Northern Ireland regions. Volumes have climbed in counties such as Offaly, Meath, Wexford and Kilkenny. Dublin is the most concentrated county for growth with 19 wind and solar projects amounting to an estimated value of €52m in the planning pipeline. Connacht and Ulster (ROI) ranked lower in planning volumes, although there was a +20% increase in Galway and a 100% increase in Roscommon. Leitrim ranked lowest in terms of growth with no new applications submitted in 2022. According to CIS calculations, the overall investment in wind and energy projects in Connacht and Ulster is €53 million, which is only marginally more than activities in Co. Dublin.

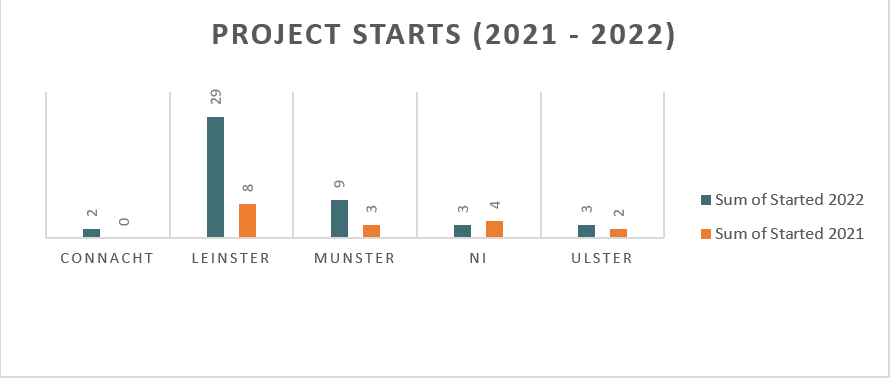

Projects Started

In comparison to the projected planning pipeline above, there is a significant variance in the number of Wind & Solar projects started across all areas. This significant disparity in volumes might indicate a downward trend in construction activity, particularly in the region of Connacht. Despite this, there was a 156% increase in the number of projects onsite in ROI, which amounted to 41 projects with a total value of €773m. However, in Northern Ireland the number of Projects Started dropped by -25%, with only 3 projects commencing on-site. Despite this significant decline, Leinster is doing fairly well, with a healthy growth of 262 percent and 29 projects onsite.

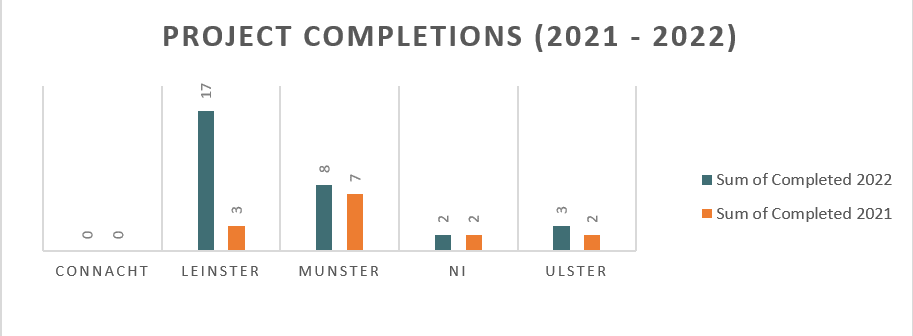

Projects Completed

From observing the modest number of finished projects, the trend remains stable across all regions bar Connacht. Leinster was the only area that experienced a significant increase in completed projects. Although, 17 projects were completed in Leinster, 12 of these projects are located in Dublin. The West’s completion forecast is poor, with no project completions recorded in the past 12 months. This research should be supplemented with the understanding that continued lockdowns and limitations in 2020/2021 may have impacted the duration or schedules of these schemes. The challenge of current chain constraint may also be at play here.

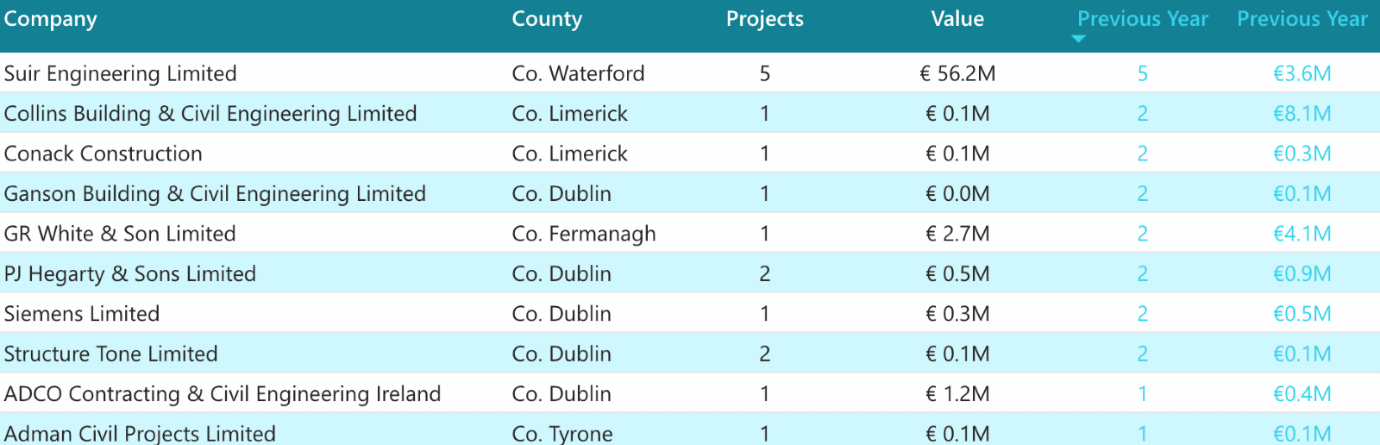

Top Contractors in Power (Energy, Wind & Solar)

The Outlook on National Schemes, Longterm Climate Action & Low Carbon Solutions to secure Ireland’s Energy

The government’s main initiative is Project Ireland 2040, which outlines plans to transition Ireland to a lower-carbon and more environmentally friendly future. Under the Public Spending Code, an indicative budget of €21.8 Billion has been strategically allocated for the period of 2018-2027 to respond to challenges such as climate change. It is hoped that by addressing current infrastructure deficits, Ireland will become more economically and climate resilient. The two main schemes outlined in Ireland 2040 are the Oweninny Windfarm in Co. Mayo and the Celtic Interconnector scheme which are both ongoing. The Oweninny Wind Farm Project is worth an overall investment of €320 with 210 wind turbines with a maximum total generating capacity of 320 mw.

We understand that statutory planning processes are ongoing for The Celtic Interconnector Project. This will allow for the transfer of 700 MW (megawatts) of electricity between Ireland. This is equivalent to powering approximately 450,000 homes. Greenlink has been identified as a European Union Project of Common Interest (PCI), making it one of the most important energy infrastructure projects in Europe. In March 2022, Greenlink Interconnector Limited (GIL) has announced financial close in on the construction of the 500MW 190km subsea and underground electricity interconnector that will connect the power grids of Ireland and Great Britain. Siemens Energy Limited, UK & Sumitomo Electric Europe, UK have commenced works on the engineering, procurement, and construction contract for Ireland-UK interconnector Project in a joint venture. Works are expected to be completed in 2024 with the possibility of powering 380,000 homes. Other significant projects in the planning pipeline include the Celtic Interconnector Project and the North South Interconnector. We understand that statutory planning processes are ongoing for The Celtic Interconnector Project which will allow for the transfer of 700 MW (megawatts) of electricity between Ireland and France.

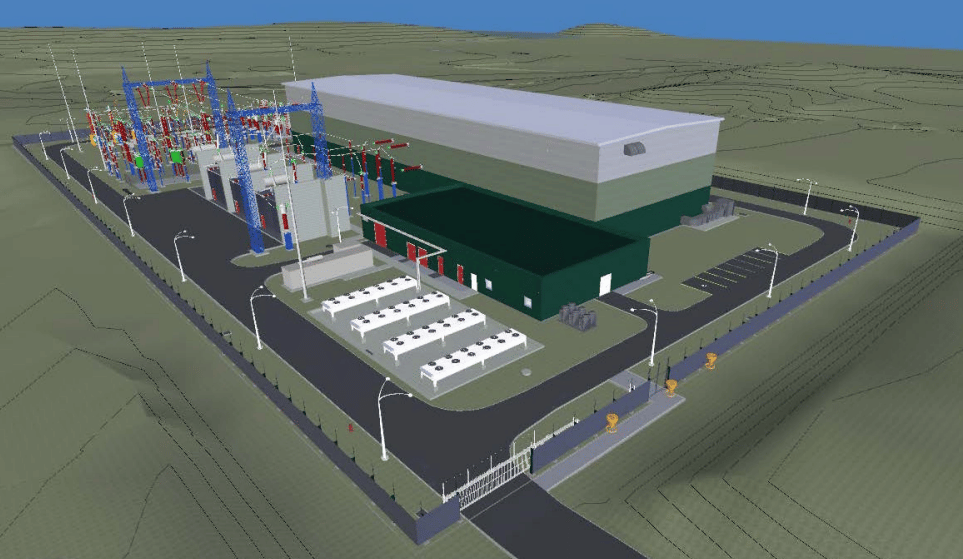

Image illustrates an example of the Greenlink Interconnector Substations. The converter station site footprint will be circa 1.85 hectares (185m x 100m) [Credit: Greenlink]

Understanding Inflation, Political Unrest & Compromised Energy Supplies

The ongoing conflict in Ukraine, as well as the long-overdue push to reduce carbon emissions and combat global warming, have undoubtedly driven crude oil prices to all-time highs. The impact of the ongoing war in Ukraine is seeping into the European Construction Market, driving up the cost of raw materials such as crude oil, aluminium, nickel, copper, and steel. The high inflation has placed great pressure on the economy which is now being felt in the construction industry. We are now witnessing the side-shock of this heavy inflation accumulating on top of the extended supply chain constraints brought about by Brexit. In recent months, high energy prices have driven raw material prices up by 20%, including steel rebars, aluminium, and copper. This was after materials costs had already risen sharply over the past two years and the outlook suggests this trend will continue to rise.

The Wave Of Upgrades, Retrofits & Transport Initiatives

In recent months, it has been promising to witness greener initiatives in construction across domestic or self builds, commercial and public sectors than ever before. CIS observed a significant increase in the installations of EV Charging Points, Energy Management Systems (Ems), Deep Retrofits and Solar Panels across all regions. DAA PLC are currently developing a Framework of contractors for the development of a 7,500kWp minimum Solar Photovoltaic (PV) plant within the Dublin Airport campus to provide on-site renewable electricity to Dublin Airport. In February 2022, The Government launched the National Retrofitting Scheme which is set to benefit public, commercial, community buildings & as well dwellings. Under administration of the SEAI, the New Home Energy Upgrade Scheme hopes to reach a target of 500,000 home energy upgrades, to B2 Building Energy Rating (BER) standard, by 2030. It is claimed that this project is among the most ambitious retrofit programmes worldwide.

Allocations for the funding of active travel projects in rural areas are higher than ever. With over €70m of funding granted from the NTA in February 2022, it is a significant opportunity for local authorities to develop high-quality, safe walking and cycling infrastructure in rural towns and villages. The draft transport strategy for the Greater Dublin Area hopes to scope out transport schemes and measures needed to tackle climate change, reduce congestion, provide a safe cycling environment and develop sustainable communities. Efforts from the Shared Island Initiative and the Greenways Strategy are working to increase Greenway infrastructure across Ireland and particularly in Border Regions.

Conclusion

The easing of Covid-19 restrictions may have given the slowed construction sector a lifeline, but cost pressures have continued to climb as a result of the conflict in Ukraine and stalled economic recovery from lockdowns. CIS have observed promising movement on state energy projects that will undoubtedly add greatly to the state’s energy and grid services. In terms of tendering and contracts, CIS have identified many public projects tender stage being pushed down the line, retendered due to the rising material costs or contractors opting to pull out of the tendering process. According to industry reports, the government is under pressure from businesses to include fluctuation clauses that allow contract pricing to be altered in order to keep projects on track. With the findings of the latest IPCC stating the necessity to halve global emissions by 2030, hard and fast efforts will be required across all nations to stabilise the rising temperature of the planet.

Dublin has emerged as the unlikely epicentre of activity within the renewable energy sector. Solar Power is the dominant choice in Leinster and Southern regions of Ireland. Wind energy projects came out on top in the West. There is a promising planning pipe of renewable energy projects in Connacht, however onsite activity and completion are the lowest in Connacht. It is self-evident that the potential wind energy of the “Wild West” is yet to be fully realised in this respect. The potential of coastal and offshore wind options are being explored more and more as Ireland tries to stave off reliance on fossil fuel, oil and gas. In terms of planning, it is possible that the judicial review process is causing delays in the project’s construction and completion stages. With staff shortages and long review times in An Bord Pleanála, the review processes have become lengthier in recent times for Strategic Infrastructural Developments, Electricity Development Applications and Private Development Applications. It is hoped that the renewable energy sector may grow rapidly in order to achieve net zero targets halfway for Ireland’s sustainability and stewardship to future generations.

CIS monitors and tracks all construction activity from the point of planning to completion. If you are interested to know more about this analysis please do not hesitate to email me on [email protected] or at [email protected]. You can also sign up to a no obligation free trial of CIS Online by clicking here or emailing the team at [email protected]

Download CIS reports by clicking the button below.

Download CIS reports by clicking the button below.